Dell Technologies

Dell Technologies is a multinational technology company specializing in computer hardware and software, data storage, and IT services for individuals, small and medium-sized businesses (SMBs), and enterprise organizations.

Launched in 1984, the Round Rock, Texas-based IT company has four decades of experience bringing personal computers (PC), workstations, and laptops to market, including multiple years as the world’s largest PC manufacturer. Dell remains one of the largest technology companies globally, with a growing stack of information technology services to aid its industry-recognized infrastructure solutions.

This article looks at the company’s products, solutions, clients, competitors, industry recognition, financial position, and historical background.

In this definition...

Dell Products and Solutions

Dell has an extensive portfolio of solutions addressing end-to-end IT needs. The company has almost everything from products for small businesses, employees, and infrastructure to emerging technologies like cybersecurity, DevOps, and edge computing.

Individuals and Consumer Products

Dell is best known for its laptops, desktops, thin clients, and electronic accessories for everyday home or office use. The company’s offerings for personal or business customers come in several models with varying specs, including specialized hardware for gaming, data storage, and workstations.

Read why Dell’s CTO and Mark Hamill Talk About IT’s Autonomous Future on Datamation.

Commercial and Enterprise Solutions

Larger organizations and data centers recognize Dell’s servers, networking, software, and hyper-converged infrastructure solutions. With the acquisition of data storage leader EMC in 2016, Dell EMC solidified the enterprise’s position atop the infrastructure industry.

PowerEdge Servers

Servers for small business to enterprise workloads are available through Dell’s portfolio of PowerEdge servers. Clients can choose from a general-purpose rack, tower, and rugged servers or consider creating a unique design through a PowerEdge modular server.

With OpenManage, customers can also minimize the complexity of modern IT infrastructure through management software for integrated Dell Remote Access Controller (iDRAC), mobile devices, power consumption, monitoring, key management, and embedded systems.

Data Storage Portfolio

The Dell EMC portfolio of data storage solutions covers primary storage, unstructured data storage, specific storage workloads, add-ons, and storage management solutions. Notable products in these stacks include:

Primary Storage Solutions

- PowerStore: All-solid-state storage system for flash and SCM Optane devices

- PowerMax: Non-Volatile Memory Express (NVMe) architecture hardware

- PowerVault: Tape drives, direct-attached storage (DAS), network-attached storage (NAS), and storage area network (SAN) devices

- Unity XT: All-flash and hybrid storage with enterprise and multi-cloud features

- VMAX: Scalable storage platforms for open systems and mission-critical workloads

Unstructured Data Storage Solutions

- PowerScale: Scale-out NAS solution for distributed file systems and object storage

- ECS: Software-defined elastic cloud storage for traditional and complex workloads

- ObjectScale: Kubernetes-native object storage for VMware and Red Hat

- SDP: Streaming data platform for ingesting, storing, and analyzing edge streaming data

Storage Management Solutions

- CloudIQ: Cloud-based machine learning to monitor the health of IT environments

- CloudLink: Encryption and key management for public, private, and hybrid cloud data

- DataIQ: Monitor and manage datasets across PowerScale and Isilon storage

- PowerPath: VM or containerized data path management between servers and storage

- VPLEX: Network-based virtualized storage for continuous app data availability

Managing Specific Workloads

Dell offers data storage solutions for specific use cases, including artificial intelligence (AI) and analytics, as the IT landscape evolves. The company also provides storage solutions to manage SAP, Oracle, Microsoft SQL, and VMware deployments for particular enterprise applications.

Also read: Best Enterprise-Grade NAS Solutions | ServerWatch

Networking Solutions

With advancements in virtual and edge computing, managing modern IT infrastructure means connecting and monitoring systems across an increasingly complex web of networks. Dell EMC’s networking portfolio covers this spectrum from the edge to the data center core and cloud infrastructure with network operating systems, edge platform solutions, and Ethernet switches.

With PowerSwitch, customers can deliver network performance up to 400GbE for data centers and 40GbE for a campus or branch office. Alternatively, the Virtual Edge Platform (VEP) offers a single, open hardware platform to optimize Virtual Network Functions (VNF) and modernize wide-area networks (WAN).

Hyperconverged Infrastructure

The Hyperconverged Infrastructure (HCI) portfolio offers customers a handful of solution families available in rack-scale appliance systems or node building blocks and running on the company’s PowerEdge servers. These solutions include:

- VxRail: Compute, storage, virtualization, and networking in a single device

- PowerFlex: Software-defined platform for computing and storage

- vSAN Ready Nodes: Bundle of PowerEdge servers with VMware vSAN

- XC Family: Bundle of Dell XC Core nodes with Nutanix HCI software

Any interest in developing in-house converged infrastructure? Dell can help with its Ready Stack designs for building CI with the company’s servers, storage, open networking, and data center solutions. For a turnkey solution, the VxBlock System 1000 is one of the company’s most potent products, offering a perpetual architecture, lifecycle management, and converged automation.

Read more: Top Channel Partner: Dell | Channel Insider

IT Services

Dell’s solutions include services for homes, small businesses, and medium to large organizations. The enterprise vendor offers consulting, deployment, implementation, incident response, and managed services for larger clients.

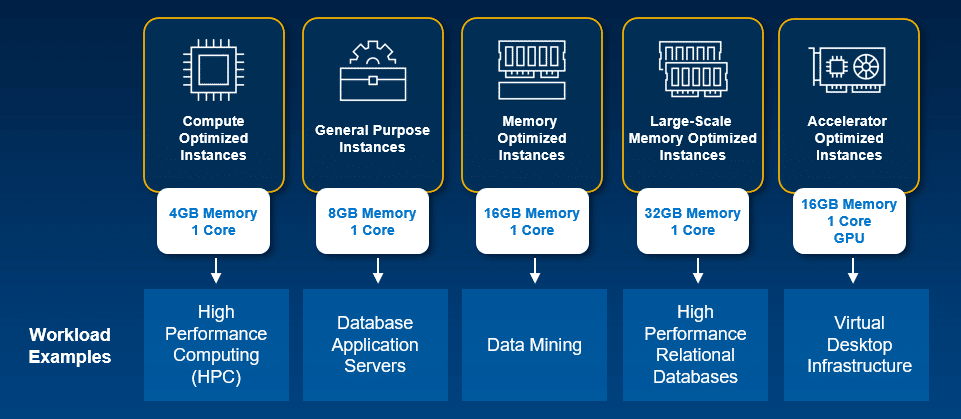

APEX Portfolio of Cloud Services

While Dell has long been a leader in on-premises infrastructure, APEX is the company’s budding stack of cloud-based services for clients. Customers can find and choose services through the self-serve APEX console, subscribe, and deploy those services within minutes. Administrators can monitor, provision, and optimize their services in real time to meet organization needs.

For computing solutions, APEX is available as an on-premises infrastructure-as-a-service (IaaS) solution for private, hybrid, and public cloud environments. Similarly, clients can find scalable and elastic storage solutions for multi-cloud data and backup services. The APEX stack also includes professional services to help clients or a Flex on Demand plan to only pay for the technology needed.

Read more about the company’s cloud services with eWeek’s Dell APEX: Increasing Consistency in Multi-Cloud Deployments.

Software

Existing and prospective clients looking over Dell’s website will also find almost 400 third-party software solutions offered for productivity, graphic design, accounting, backups, and more. Solution types include boxed software, a subscription, downloadable software, or volume licensing.

Customers can bundle software from over 20 vendors, including Adobe Systems, Autodesk, AVG, Bitdefender, Cyberlink, HR Block, MAGIX, McAfee, Microsoft, and SonicWall.

Target Markets

Dell serves clients in nearly every industry across global markets with its stack of IT solutions. Specific sectors served by the company include financial services, healthcare, energy, manufacturing, and telecommunications. Meanwhile, the company’s clientele includes public sector agencies, enterprises, SMBs, and home customers.

Dell Competitors

Also read: Dell APEX: Increasing Consistency in Multi-Cloud Deployments | eWeek

Industry Recognition and Reviews

Dell Technologies has an abundance of recognition as an industry giant through industry reports like the Forrester Wave, Gartner Magic Quadrant, and IDC MarketScape.

The Forrester Wave

| Industry Report | When | What |

| AI Infrastructure | Q4 2021 | Strong Performer |

| CloudEngine Data Center Switches | Q3 2020 | Contender |

| Data Resiliency Solutions | Q3 2019 | Challenger |

| Strategic iPaaS and Hybrid Integration Platforms | Q1 2019 | Leader |

| Hardware Platforms for Software-Defined Networks | Q1 2018 | Contender |

Gartner Magic Quadrant and Peer Insights

| Industry Report | When | What |

| Distributed File Systems and Object Storage | 2021 | Leader |

| Primary Storage | 2021 | Leader |

| Enterprise Integration Platform as a Service | 2020 | Leader |

| Data Center Networking | 2020 | Visionary |

Dell holds over 2,400 client reviews with an average score of 4.6 out of 5 stars across more than a dozen solution categories on Gartner Peer Insights, including:

- Enterprise Backup and Recovery Software Solutions

- Hyperconverged Infrastructure Software

- Client Management Tools

- Enterprise Information Archiving

Clients highlight interoperability with third-party platforms, general reliability and scalability of products, and enterprise capabilities in customer reviews.

IDC MarketScape

| Industry Report | When | What |

| Worldwide Support Services | 2019 | Leader |

| Worldwide Object-Based Storage | 2019 | Leader |

| Worldwide Scale-Out File-Based Storage | 2019 | Leader |

| Worldwide Cloud Professional Services | 2018 | Major Player |

Read more: Dell Makes Strong Push Towards Autonomous Operations | IT Business Edge

Partner Program and Global Alliances

The Dell Technologies Partner Program offers extensive benefits to channel partners, including added marketing, sales, and development resources for working with the IT giant. Starting as a reseller, the company now leads a multinational force of resellers to deliver products to end customers.

Dell maintains global alliances with over 325 IT channel partners with partner types like solution providers, system integrators (SI), strategic outsourcers (SO), cloud service providers (CSP), original equipment manufacturers (OEM), distributors, and federal partners. Notable partners include:

| System Integrators | Strategic Outsourcers | Cloud Service Providers |

| Accenture Cognizant Deloitte Infosys Tata Consultancy Services Wipro | Atos Dimension Data DXC Technology IBM Sungard Unisys | Deutsche Telekom Iron Mountain Orange Business Services Logicworks Rackspace Xerox |

Learn more about joining the Dell Partner Program with Channel Insider’s guide to partner requirements, tiers, incentives, and resources for the IT channel ecosystem.

Dell: Company Background

In 1984, a freshman at the University of Texas, Michael Dell, launched PC’s Limited. With a business model selling directly to consumers, first IBM PCs and then its proprietary designs starting in 1985, the company was a success story within a few years.

By 1988, the company would take the name Dell Computer Corporation and go public before moving into EMEA and APAC regions in the years after. Through the 1990s and early 2000s, Dell cemented itself as a leading PC manufacturer and IT infrastructure provider.

Today, the company has over 165,000 employees across 291 offices in 72 countries, with corporate headquarters in Round Rock, Texas.

Read more about work at the company with Datamation’s Dell Technologies Careers Review.

Growth, Acquisitions, and Financials

Dell’s presence in the IT industry is thanks to its over two dozen acquisitions, including a handful of emerging technology and market-leading companies. These acquisitions include:

- Computer hardware company Alienware in 2006

- Information technology company Perot Systems in 2009

- iPaaS company Boomi and NAS company Exanet in 2010

- Cybersecurity company Secureworks and network switch company Force10 in 2011

- Cybersecurity company SonicWall and software company Quest in 2012

- Information technology company EMC in 2016 (including VMware; see Dell EMC)

Though Dell went public early in its early history, founder Michael Dell and private equity partners bought out the public stake in 2013 for almost $24 billion. Six years later, the company would return to the New York Stock Exchange and reclaim the eponymous ticker, DELL.

Despite the spin-off of a significant operating segment VMware in November 2021, Dell still reported a fiscal year annual revenue of $101.2 billion, up 17%, in 2022.

| Segment | 2020 Revenue | 2021 Revenue |

| Infrastructure Solutions | $34.0 billion | $34.4 billion |

| Client Solutions | $45.8 billion | $61.5 billion |

| VMware | $10.9 billion | – |

Above is a look at how revenues compare between operating segments showing a nearly 27% jump for the company’s Client Solutions Group in 2021.

Dell EMC

Five years before the founding of Dell, in 1979, former college roommates Richard Egan and Roger Marino launched EMC outside Boston, Massachusetts. Initially developing memory boards for computer manufacturers, EMC moved into data storage and network storage software by the late 1980s.

EMC’s market presence was considerable moving into the new millennium, leading it to become the largest tech employer in Massachusetts. Strategic acquisitions giving EMC an even more dominant industry position included:

- Content management software company Documentum in 2003

- Virtualization and cloud computing company VMware in 2004

- Network security and authentication company RSA Security in 2006

- Cloud computing and IaaS company Virtustream in 2015

In September 2016, Dell Technologies confirmed the most significant IT deal in history with the acquisition of EMC Corporation for $67 billion. The merger of the storage giant with the computer giant resulted in the formation of the subsidiary Dell EMC, whose operations remain headquartered in Hopkinton, Massachusetts.

Recent Coverage

- Dell Technologies at CES: The Importance of Endpoint Evolution | eWeek

- Dell introduces a redesigned XPS desktop and 2 new Aurora machines | TechRepublic

- Dell Technologies Showcases Effective Approach to Keynotes | IT Business Edge

- Dell Technologies APEX and the Partner Ecosystem | eWeek

- Dell Data Protection vs McAfee Complete Data Protection | TechRepublic

- Dell APEX and Why the Industry is Pivoting to Services Model | Datamation